February 2024 Economic Review

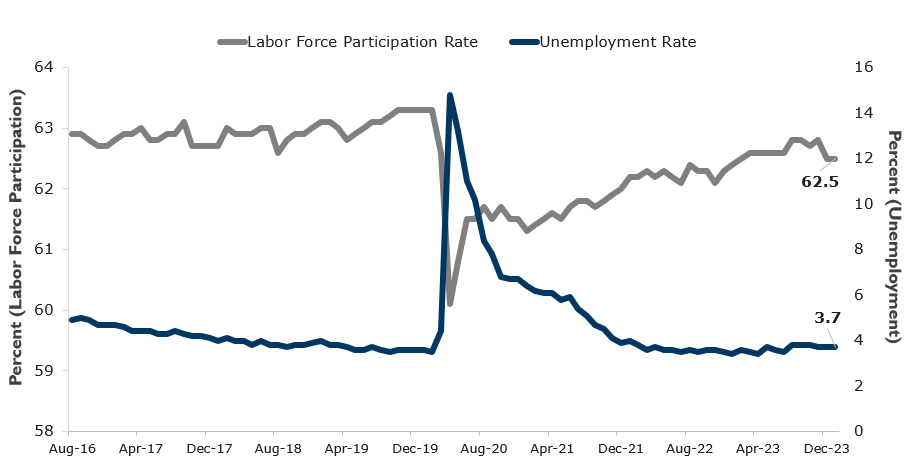

The economy showed surprising strength in 2023 by growing 2.5 percent, defying market expectations for the U.S. to slip into a recession under the weight of rising interest rates and high inflation. January’s labor market report continued this trend, with the economy adding 353,000 non-farm payroll jobs, almost twice the median forecast. In addition, the unemployment rate remains firmly below 4.0 percent, an indication of a historically strong labor market. Buffered by these tailwinds, the Federal Reserve has firmly pushed back on the notion that it will execute a rapid succession of rate cuts early in 2024.

To the contrary, the Federal Reserve has signaled its comfort in maintaining the federal funds target rate at a 23-year high as it awaits further confirmation that inflation is firmly under control. With prices reaccelerating in January, led by shelter costs, medical care, and transportation services, the data shows the fight against inflation may be far from over. Hence, any prospect of a March or May rate cut should likely be put aside for the moment.

However, the longer monetary policy remains restrictive, the greater the odds that higher borrowing costs and tighter lending standards may negatively impact the economy. When the Federal Reserve signaled in December that it was through with rate hikes, the market may have miscalculated how quickly rate cuts would materialize. But then again, this is the same Fed that deemed inflationary pressure as “transitory’ in 2021. For now, we should welcome the prospect of market stability with Fed and investor expectations growing more in sync over the past few weeks.

Current Economic Releases |

|||

| Data | Period | Value | |

| GDP QoQ | Q4 ’23 | 3.30% | |

| US Unemployment | Jan ’24 | 3.70% | |

| ISM Manufacturing | Jan ’24 | 49.1 | |

| PPI YoY | Dec’23 | 1.00% | |

| CPI YoY | Jan ’24 | 3.10% | |

| Fed Funds Target | Feb 13, 2024 | 5.25% – 5.50% | |

Treasury Yields |

|||

| Maturity | 2/13/24 | 1/12/24 | CHANGE |

| 3-Month | 5.384% | 5.123% | 0.262% |

| 6-Month | 5.328% | 5.166% | 0.162% |

| 1-Year | 4.965% | 4.655% | 0.309% |

| 2-Year | 4.601% | 4.144% | 0.457% |

| 3-Year | 4.400% | 3.928% | 0.473% |

| 5-Year | 4.264% | 3.830% | 0.434% |

| 10-Year | 4.277% | 3.939% | 0.338% |

| 30-Year | 4.445% | 4.175% | 0.270% |

Agency Yields |

|||

| Maturity | 2/13/24 | 1/12/24 | CHANGE |

| 3-Month | 5.570% | 5.342% | 0.228% |

| 6-Month | 5.370% | 5.197% | 0.173% |

| 1-Year | 5.130% | 4.819% | 0.311% |

| 2-Year | 4.750% | 4.287% | 0.463% |

| 3-Year | 4.738% | 4.300% | 0.438% |

| 5-Year | 4.330% | 3.943% | 0.387% |

| 6-Month | 5.330% | 5.350% | -0.020% |

| 9-Month | 5.270% | 5.240% | 0.030% |

Source: Bloomberg. Data as of February 12, 2024. Data unaudited. Many factors affect performance including changes in market conditions and interest rates and in response to other economic, political, or financial developments. Investment involves risk including the possible loss of principal. No assurance can be given that the performance objectives of a given strategy will be achieved. All comments and discussions presented are purely based on opinion and assumptions, not fact. These assumptions may or may not be correct based on foreseen and unforeseen events. The information presented should not be used in making any investment decisions. This material is not a recommendation to buy, sell, implement, or change any securities or investment strategy, function, or process. Any financial and/or investment decision should be made only after considerable research, consideration, and involvement with an experienced professional engaged for the specific purpose. Past performance is not an indication of future performance. Any financial and/or investment decision may incur losses.