March 2024 Economic Review

The Federal Open Market Committee (FOMC) has finally begun to seriously consider the prospect of rate cuts after the most aggressive tightening cycle in four decades to rein in inflation. Chairman Powell’s December press conference was widely seen by the market as a “dovish” pivot, with Powell acknowledging during Q&A that the discussion of rate cuts among FOMC participants, “will be a topic for us, looking ahead.” The Chairman followed this up at his January press release by stating, “Our policy rate is likely at its peak for this tightening cycle” and that “it will likely be appropriate to begin dialing back policy restraint at some point this year.”

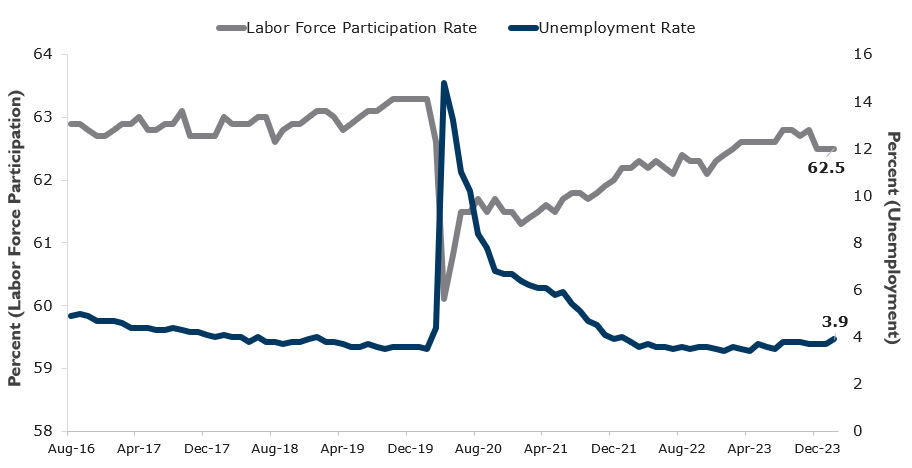

Nonfarm payrolls for February came in at an above-consensus +275k, masking weakness underneath the headline. Revisions lower to the prior two month’s total jobs numbers, a jump of 0.2% in unemployment, and a sharply lower increase in hourly earnings month-over-month indicate a labor market that is potentially much closer to balance than the topline number would otherwise indicate. This reading and any subsequent readings with similar “balanced” data will give ammunition to members of the FOMC who are in favor of easing policy later in the year.

The February CPI numbers came in as expected on the headline but so-called “core” readings, minus food and energy, came in above expectations at +0.4% month-over-month and +3.2% year-over-year. While the Fed has made serious progress since inflation peaked in the summer of 2022, the remaining march towards 2.0% could be a volatile and more complicated challenge. The last two CPI readings were stronger than anticipated and far from a clear win the FOMC needed to lower rates as early as the March meeting.

According to the Fed Fund Futures, market participants are currently pricing in a full cut to the Federal Funds Rate by the July FOMC meeting; however, markets have continued to be proven wrong with their overly aggressive assumptions on easing during the current cycle. Powell’s commentary during the press conference as well as updated dot-plot and economic projections released on March 20th should give us an indication of how much further progress the Fed is looking for in terms of inflation before they are willing to ease policy from multi-decade highs.

Current Economic Releases |

|||

| Data | Period | Value | |

| GDP QoQ | Q4 ’23 | 3.20% | |

| US Unemployment | Feb ’24 | 3.90% | |

| ISM Manufacturing | Feb ’24 | 47.8 | |

| PPI YoY | Jan ’24 | 0.90% | |

| CPI YoY | Feb ’24 | 3.20% | |

| Fed Funds Target | Mar 13, 2024 | 5.25% – 5.50% | |

Treasury Yields |

|||

| Maturity | 3/12/24 | 2/13/24 | CHANGE |

| 3-Month | 5.379% | 5.387% | -0.008% |

| 6-Month | 5.310% | 5.344% | -0.033% |

| 1-Year | 4.995% | 5.000% | -0.006% |

| 2-Year | 4.586% | 4.658% | -0.072% |

| 3-Year | 4.331% | 4.465% | -0.134% |

| 5-Year | 4.148% | 4.316% | -0.168% |

| 10-Year | 4.151% | 4.314% | -0.164% |

| 30-Year | 4.312% | 4.463% | -0.150% |

Agency Yields |

|||

| Maturity | 3/12/24 | 2/13/24 | CHANGE |

| 3-Month | 5.230% | 5.240% | -0.010% |

| 6-Month | 5.170% | 5.180% | -0.010% |

| 1-Year | 4.870% | 4.840% | 0.030% |

| 2-Year | 4.627% | 4.684% | -0.057% |

| 3-Year | 4.393% | 4.492% | -0.098% |

| 5-Year | 4.216% | 4.377% | -0.161% |

| 6-Month | 5.370% | 5.330% | 0.040% |

| 9-Month | 5.340% | 5.270% | 0.070% |

Source: Bloomberg. Data as of March 13, 2024. Data unaudited. Many factors affect performance including changes in market conditions and interest rates and in response to other economic, political, or financial developments. Investment involves risk including the possible loss of principal. No assurance can be given that the performance objectives of a given strategy will be achieved. All comments and discussions presented are purely based on opinion and assumptions, not fact. These assumptions may or may not be correct based on foreseen and unforeseen events. The information presented should not be used in making any investment decisions. This material is not a recommendation to buy, sell, implement, or change any securities or investment strategy, function, or process. Any financial and/or investment decision should be made only after considerable research, consideration, and involvement with an experienced professional engaged for the specific purpose. Past performance is not an indication of future performance. Any financial and/or investment decision may incur losses.