May 2024 Economic Review

The advance estimate for real GDP growth in Q1 came in at a modest 1.6% annualized rate, restrained by trade and inventory adjustments. However, underlying dynamics paint a more nuanced picture, particularly regarding consumer behavior and inflation trends, which are crucial for understanding the current economic landscape and future monetary policy.

Despite higher interest rates, households continue to spend. Real disposable income growth slowed but remained positive, and the personal saving rate dipped to 3.6%, the lowest since the end of 2022. This decline in savings suggests that consumers are increasingly dipping into their reserves to maintain spending, reflecting resilient but potentially unsustainable consumer behavior in the face of rising borrowing costs.

Inflation remains an ongoing concern, with the core Personal Consumption Expenditures (PCE) price index rising at a 3.7% annualized rate in Q1. Particularly noteworthy is the rise in services excluding energy and housing, which increased at a 5.1% annualized rate, the fastest in a year. This persistent inflation in core services represents a dilemma for the Federal Reserve (Fed), as it suggests that higher interest rates have yet to effectively curb inflationary pressures.

Digging deeper, the weak headline GDP results are largely due to trade and inventory dynamics, with net exports subtracting 0.86 percentage points from Q1 growth. Excluding volatile components like net exports, inventories, and government investment, real final sales to domestic private purchasers—a key measure of underlying domestic demand—rose at a solid 3.1% annualized rate. This metric has consistently shown strong readings above 3.0% for the past three quarters, indicating a stronger fundamental growth trend than the Q1 GDP headline suggests.

We are cautious to interpret the weak Q1 GDP results as a sign of imminent policy easing. Persistent economic resiliency and sticky inflationary pressures indicate a complex path for the Fed to achieve its 2% inflation target while maintaining economic stability. Public Trust will remain vigilant in monitoring incoming economic data for further insights into the timing of potential Fed policy adjustments.

pan style=”text-decoration: underline;”>CHANGE

Current Economic Releases |

|||

| Data | Period | Value | |

| GDP QoQ | Q1 ’24 | 1.60% | |

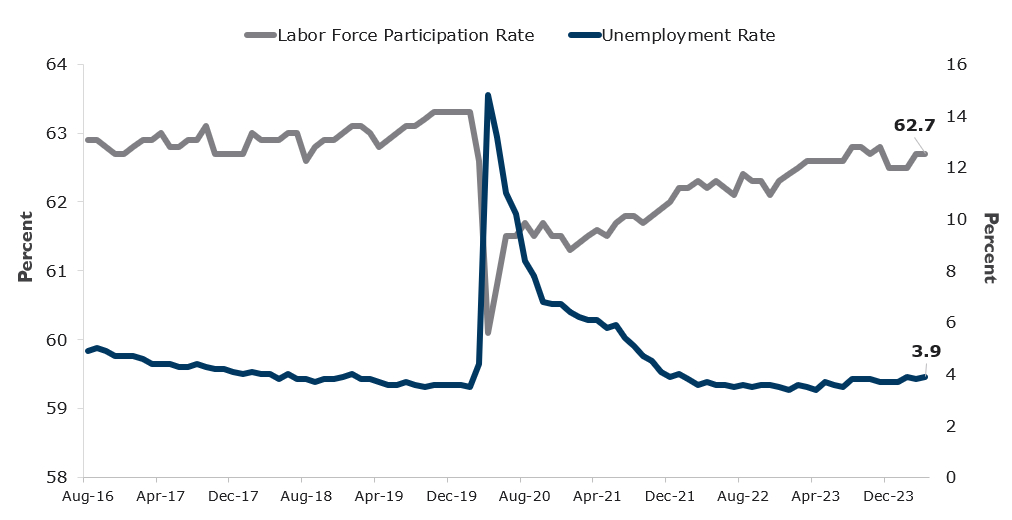

| US Unemployment | Apr ’24 | 3.90% | |

| ISM Manufacturing | Apr ’24 | 49.2 | |

| PPI YoY | Apr ’24 | 2.20% | |

| CPI YoY | Apr ’24 | 3.40% | |

| Fed Funds Target | May 15, 2024 | 5.25% – 5.50% | |

Treasury Yields |

|||

| Maturity | 5/15/24 | 4/19/24 | CHANGE |

| 3-Month | 5.388% | 5.372% | 0.016% |

| 6-Month | 5.353% | 5.366% | -0.013% |

| 1-Year | 5.087% | 5.158% | -0.072% |

| 2-Year | 4.730% | 4.986% | -0.256% |

| 3-Year | 4.511% | 4.821% | -0.310% |

| 5-Year | 4.352% | 4.670% | -0.318% |

| 10-Year | 4.354% | 4.621% | -0.267% |

| 30-Year | 4.518% | 4.711% | -0.193% |

Agency Yields |

|||

| Maturity | 5/15/24 | 4/19/24 | CHANGE |

| 3-Month | 5.270% | 5.250% | 0.020% |

| 6-Month | 5.220% | 5.220% | 0.000% |

| 1-Year | 5.100% | 5.170% | -0.070% |

| 2-Year | 4.781% | 4.989% | -0.208% |

| 3-Year | 4.569% | 4.835% | -0.265% |

| 5-Year | 4.421% | 4.710% | -0.289% |

Source: Bloomberg. Data as of May 16, 2024. Data unaudited. Many factors affect performance including changes in market conditions and interest rates and in response to other economic, political, or financial developments. Investment involves risk including the possible loss of principal. No assurance can be given that the performance objectives of a given strategy will be achieved. All comments and discussions presented are purely based on opinion and assumptions, not fact. These assumptions may or may not be correct based on foreseen and unforeseen events. The information presented should not be used in making any investment decisions. This material is not a recommendation to buy, sell, implement, or change any securities or investment strategy, function, or process. Any financial and/or investment decision should be made only after considerable research, consideration, and involvement with an experienced professional engaged for the specific purpose. Past performance is not an indication of future performance. Any financial and/or investment decision may incur losses.