November 2023 Economic Review

Stubbornly high prices showed signs of easing with the October Consumer Price Index (CPI) release. Consumer prices as measured by a broad basket of commonly used goods and services rose 3.2% from the same period last year, a slower pace than reported for September and better than market expectations. Additionally, core CPI, which excludes more volatile items like food and energy prices, increased only 0.2% from the prior month and reflected a 4.0% increase over the same period a year earlier. The inflationary cooling is due in part to a slowing in housing cost growth and lower prices for airfare and automobiles.

The positive report suggests that the Federal Reserve’s increase in interest rates over the last 18 months to a 22-year high is having the intended impact of combating inflation. During its November meeting, the Fed elected to leave interest rates unchanged, and the October CPI numbers could serve as a motivator for the Fed to maintain interest rate levels during its December meeting as well. While the October CPI release resulted in a market rally as many market participants took the report as an indicator that the Fed could be done raising rates for the foreseeable future, Chairman Powell has been firm in his stance that the Fed might not have done enough to decrease inflation all the way to the Fed’s 2.00% target level.

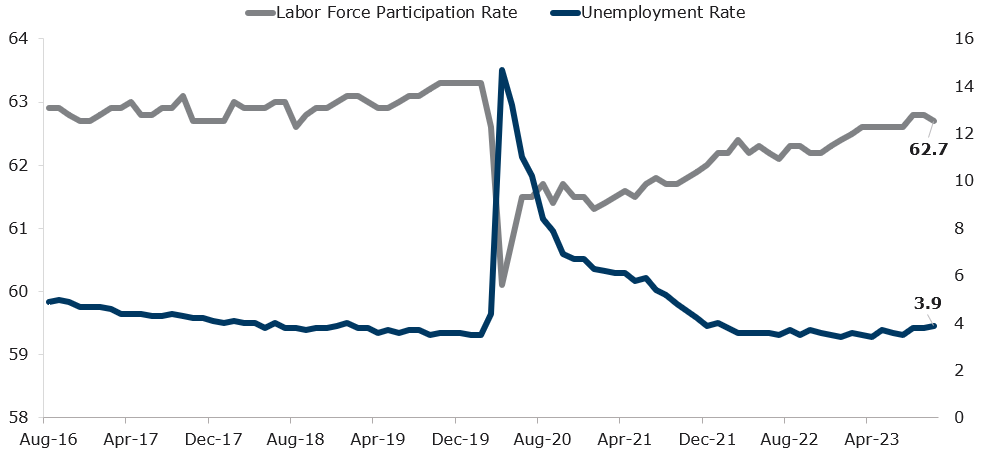

In addition to elevated interest rates, a recent cooling in the labor market could further curb inflationary pressures. October nonfarm payrolls increased by only 150,000 which was due in part to ongoing strikes at major auto manufacturers, and the unemployment rate increased by 0.1% to 3.9%, the highest level since January 2022. While recent indicators suggest that the Fed has been successful in easing inflationary pressures without triggering a recession, they have been steady in their position that they do not want inflation to reaccelerate or to settle at a level well above their 2.00% target, so the timing and direction of any potential future changes in interest rates remains somewhat uncertain.

Current Economic Releases |

|||

| Data | Period | Value | |

| GDP QoQ | Q2 ’23 | 4.90% | |

| US Unemployment | Oct ’23 | 3.90% | |

| ISM Manufacturing | Oct ’23 | 46.7 | |

| PPI YoY | Sep ’23 | 2.20% | |

| CPI YoY | Oct ’23 | 3.20% | |

| Fed Funds Target | Nov 14, 2023 | 5.25% – 5.50% | |

Treasury Yields |

|||

| Maturity | 11/10/23 | 10/12/23 | CHANGE |

| 3-Month | 5.255% | 5.343% | -0.088% |

| 6-Month | 5.456% | 5.560% | -0.104% |

| 1-Year | 5.374% | 5.395% | -0.021% |

| 2-Year | 5.062% | 5.069% | -0.006% |

| 3-Year | 4.837% | 4.846% | -0.009% |

| 5-Year | 4.684% | 4.692% | -0.008% |

| 10-Year | 4.652% | 4.697% | -0.045% |

| 30-Year | 4.762% | 4.854% | -0.093% |

Agency Yields |

|||

| Maturity | 11/10/23 | 10/12/23 | CHANGE |

| 3-Month | 5.457% | 5.505% | -0.047% |

| 6-Month | 5.511% | 5.553% | -0.043% |

| 1-Year | 5.429% | 5.489% | -0.060% |

| 2-Year | 5.100% | 5.151% | -0.051% |

| 3-Year | 4.912% | 4.952% | -0.041% |

| 5-Year | 4.791% | 4.815% | -0.025% |

Source: Bloomberg. Data as of November 14, 2023. Data unaudited. Many factors affect performance including changes in market conditions and interest rates and in response to other economic, political, or financial developments. Investment involves risk including the possible loss of principal. No assurance can be given that the performance objectives of a given strategy will be achieved. All comments and discussions presented are purely based on opinion and assumptions, not fact. These assumptions may or may not be correct based on foreseen and unforeseen events. The information presented should not be used in making any investment decisions. This material is not a recommendation to buy, sell, implement, or change any securities or investment strategy, function, or process. Any financial and/or investment decision should be made only after considerable research, consideration, and involvement with an experienced professional engaged for the specific purpose. Past performance is not an indication of future performance. Any financial and/or investment decision may incur losses.